This article covers the best budgeting apps for smart money management that can transform your financial management and help you take control of your spending in 2025.

Introduction

Writing down expenses in notebooks or spreadsheets often leads to forgotten receipts and missed bills. Your budget plans might start strong but quickly become outdated as life gets busy. Modern budget tracker apps solve these common problems by automatically recording your spending and organizing your finances in real time. They help you stay on track with your money goals without the hassle of manual tracking.

Before you choose a budgeting app, you’ll want to look at four main things. First, check if the app keeps your financial data safe with strong security features. Second, see what tools it offers for tracking expenses and setting goals. Third, compare prices since some apps are free while others charge monthly fees. Finally, try the app yourself to make sure it’s easy to use and understand. These points will help you find an app that fits your needs and makes managing money simpler.

Understanding Budgeting App Benefits

Remember writing down every purchase in spreadsheets? While spreadsheets work, they need lots of time and effort to maintain. Modern budgeting apps now do this work automatically. You can see your spending right on your phone, making it easier to stay on top of your money.

A good budgeting app works as your personal expense tracker, showing you exactly where your money goes. Your morning coffee, grocery shopping, and bill payments are all recorded automatically when you use your cards. This gives you a clear picture of your spending habits without any manual work. You can spot areas where you spend too much and find ways to save money faster.

Many people worry about connecting their bank accounts to budgeting apps. Today’s budgeting apps use the same security systems as major banks. Companies like Plaid help keep your information safe by using strong encryption to protect your data. Plus, most budgeting apps can only see your transactions and can’t move your money, giving you an extra layer of safety.

How to Choose a Budgeting App

Your financial goals should guide your choice of a budgeting app. If you want to save for a house, look for the best budgeting apps for smart money management with strong savings trackers. If you need help with daily spending, pick an app with good expense categories and real-time updates. The right app will match your specific money needs.

- Automatic syncing: Links to your bank accounts and credit cards to update transactions

- Custom categories: Groups your spending in ways that make sense for you

- Bill reminders: Sends alerts before bills are due

- Investment tracking: Shows all your investments in one place

- Reports: Creates charts and graphs of your spending patterns

The choice between free and paid apps depends on your needs. Free apps usually offer basic features like expense tracking and basic budgeting. Paid apps typically include more features like investment tracking, detailed reports, and better customer support. Consider starting with a free app to learn what features matter most to you before deciding if a paid version would be worth the investment.

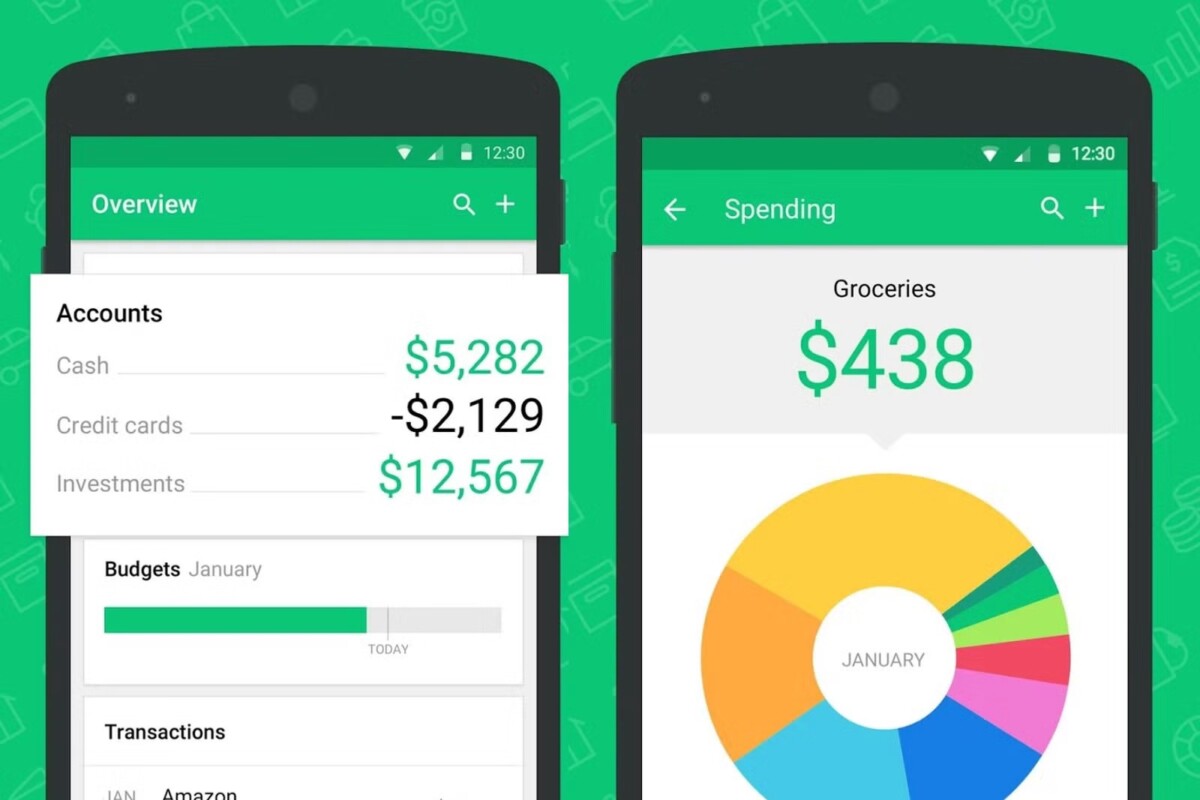

Mint

Mint helps you track your money and create budgets without spending hours on spreadsheets. You’ll find it useful if you want to see all your accounts in one place and get alerts about your spending habits.

- Cost: Free

- Account Tracking: Links to bank accounts, credit cards, loans, and investments

- Budgeting Tools: Creates custom budgets based on your spending patterns

- Bill Management: Shows upcoming bills and sends payment reminders

- Security: Bank-level encryption to protect your data

- Extra Features: Credit score monitoring and customized money-saving tips

Mint stands out because it automatically sorts your expenses into categories and shows clear graphs of your spending. The app is easy to set up and works well for beginners. However, you might notice some connection issues with certain banks, and the free service includes ads for financial products. Some users also mention that the investment tracking features could be more detailed. Still, if you’re looking for a free way to manage your money, Mint offers good value with its basic features.

YNAB (You Need A Budget)

YNAB uses zero-based budgeting to help you manage your money. This means you plan where every dollar will go before you spend it. Think of it like giving each dollar a job: some dollars are for groceries, others for rent, and some for fun activities. This method helps you stay in control of your spending and save more money.

- Key Features:

- Real-time sync across all your devices

- Bank account linking for automatic updates

- Free workshops and learning resources

- Goal tracking for savings targets

- Price: $14.99 monthly or $99 annually with a 34-day free trial

Learning YNAB might take a few weeks to get comfortable with, but the results are worth it. The app includes helpful tutorials, video guides, and a supportive community to help you learn. Many users report feeling more confident about their finances after using YNAB for just one month. The key is to stick with it through the initial learning phase. The app’s education resources make this process much easier, especially if you’re new to budgeting. https://www.youtube.com/embed/aHk0dK4L_Ok

Personal Capital

Personal Capital combines basic budgeting with advanced investment management tools. While you can use its free budgeting features, the platform really shines when you want to track and manage your investments. The free version gives you useful investment tracking tools, retirement planning calculators, and spending insights.

- Premium Wealth Management: Personal advisor for portfolios over $100,000

- Investment Strategy: Custom portfolio management and rebalancing

- Tax Optimization: Strategies to reduce your investment taxes

- Financial Planning: Complete retirement and education planning

- Cost Structure: Annual fee ranges from 0.49% to 0.89% of managed assets

This app works best if you have significant investments or want to build wealth over time. You’ll benefit most from Personal Capital if you need help managing multiple investment accounts, planning for retirement, or want professional guidance for your money decisions. The free version gives you good budgeting tools, but the real value comes from the investment management features if you have a larger portfolio.

PocketGuard

PocketGuard makes budgeting less complicated with its spending tracker that shows you exactly where your money goes. The app looks at your income and bills, then tells you how much you can spend each day. You’ll see your spending patterns clearly without getting lost in complex charts or confusing numbers.

- Core Features:

- Real-time balance updates

- Bill payment reminders

- Customizable spending categories

- Savings goals tracking

- Free Plan: Basic budgeting and expense tracking

- PocketGuard Plus: $7.99/month or $79.99/year with advanced features

The app connects to your bank accounts and credit cards to track your transactions automatically. Once connected, PocketGuard organizes your expenses into categories and spots ways you could save money. The app finds better deals on bills and subscriptions you already pay for, helping you cut costs without much effort on your part.

EveryDollar

Dave Ramsey created EveryDollar as part of his personal finance teaching method. The app follows his popular “baby steps” system, which helps you build an emergency fund and pay off debt. You’ll find his principles built into every part of the app, from how you set up your budget to tracking your spending.

- Free Version Features:

- Basic budget setup and tracking

- Manual transaction entry

- Custom budget categories

- Monthly and annual planning

- Premium Version ($129.99/year):

- Bank account connection

- Automatic transaction imports

- Debt payoff tracking

- Access to Financial Peace University content

- Phone support

The app works well if you want to get out of debt. You can watch your debt decrease month by month and celebrate small wins along the way. The debt snowball method, which focuses on paying off your smallest debts first, comes built into the premium version. This helps you stay motivated as you see each debt disappear from your list. The app also shows you exactly how much money you have left to spend in each category, which helps prevent overspending before it happens.

Goodbudget

Goodbudget brings the traditional envelope budgeting method to your phone. You can sort your money into digital envelopes for different spending categories, like groceries, gas, or entertainment. This helps you track exactly where your money goes and stick to your spending limits.

- Key Features:

- Digital envelope system

- Debt tracking tools

- Savings goals tracker

- Bill payment reminders

- Free version includes 10 envelopes

- Plus version ($8/month) offers unlimited envelopes

The app works well for families who want to manage money together. You can share your budget with your partner or family members, so everyone stays on the same page about spending. Each person can check envelope balances and update expenses from their own device, which helps prevent overspending and keeps everyone accountable.

Truebill

Your bills and subscriptions can get out of hand quickly. Truebill helps you spot and cancel services you don’t use anymore. The app looks through your spending to find recurring charges and shows them all in one place. You’ll get alerts about price increases and can use the app to negotiate lower rates on many common bills.

- Bill Negotiation: Looks for better rates on cable, internet, and phone bills. Takes 40% of yearly savings as payment

- Subscription Monitor: Shows all your subscriptions in one view. Sends alerts for price changes

- Smart Savings: Automatically moves money to savings based on your spending habits

- Credit Score: Free credit score monitoring and updates

- Premium Features: $3 to $12 monthly based on what you choose to use

Managing your subscriptions with Truebill can save you money without much effort. The app helps you spot those forgotten subscriptions that quietly charge your card each month. You can quickly see which services you actually use and cancel the ones you don’t need right from the app. This makes it much easier to keep track of your monthly expenses and avoid paying for things you’ve forgotten about.

Simplifi by Quicken

Simplifi helps you understand your spending habits without complicated spreadsheets or confusing charts. This savings app looks at how you use your money and shows you exactly where it goes each month. You’ll get clear insights about your spending that actually make sense and help you save more.

- Real-time tracking: See all your accounts and transactions in one place

- Smart categories: Your expenses are automatically sorted into groups that match your life

- Spending plan: Create flexible monthly budgets that work with your income

- Watchlists: Keep an eye on specific expenses like groceries or entertainment

- Price: $3.99 monthly or $35.99 yearly subscription

The app uses smart technology to study your spending patterns and suggest better ways to manage your money. It spots areas where you might be spending too much and recommends simple changes you can make. These suggestions are based on your actual habits, not generic advice that might not work for your situation. The recommendations get better over time as the app learns more about how you handle your money.

Conclusion

Choosing your budgeting app depends on what matters most to you. If you want detailed reports, pick an app with strong analytics. If you need help saving money, look for apps with savings goals and automatic transfers. Your comfort with technology and preferred level of detail should guide your choice.

Looking at the most common needs, we recommend starting with Mint if you want a free, all-in-one solution. For those who prefer a simple envelope budgeting system, YNAB works well. If you mainly want to track spending, PocketGuard offers an easy way to start.

Want to learn more about managing your money and finding the right financial tools? Visit Fundsamentally for helpful guides and tips about personal finance management. Our resources will help you make smart choices about your money and budgeting tools.

FAQ

Are budgeting apps safe to use?

Most budgeting apps use the same security features as banks, including encryption and secure data storage. Your information is protected by strong passwords and often additional security measures like fingerprint or face recognition. Look for apps that use bank-level encryption (256-bit) and read their security policies before signing up.

How much do budgeting apps typically cost?

You’ll find many free budgeting apps with basic features. Premium versions usually cost between $5 and $15 per month. Some apps offer yearly subscriptions at a lower rate. Popular apps like Mint are completely free, while others like YNAB charge a subscription fee for advanced features.

Can I use multiple budgeting apps together?

Yes, you can use several budgeting apps at once. Each app might serve a different purpose. For example, you might use one app for tracking daily expenses and another for long-term savings goals. However, using multiple apps might make it harder to get a complete picture of your finances in one place.

Do I need to connect my bank accounts?

No, connecting your bank accounts is optional. While automatic syncing makes tracking easier, most apps let you enter transactions manually. Manual entry can actually help you become more aware of your spending habits since you’ll need to record each purchase yourself.

What if my bank isn’t supported?

If your bank isn’t supported for automatic syncing, you have several options. You can manually enter your transactions, upload bank statements in supported formats, or contact the app’s support team to request adding your bank. Many apps regularly add new banks to their supported list.

How long does it take to set up a budgeting app?

Basic setup usually takes 15 to 30 minutes. This includes creating an account, setting up your budget categories, and connecting your bank accounts if you choose to do so. The more accounts and features you want to use, the longer the setup will take. You might need extra time to customize categories and set financial goals.

Looking for credit card help too? Read more