Fed Optimism vs. Public Sentiment

The Federal Reserve may feel it’s winning the fight, but Americans aren’t convinced.

A recent AP-NORC poll found only one in three voters think the economy is doing well, even after the Fed’s rate cut. Interestingly, about six in ten say their personal finances are okay.

This gap between the economic data and how people feel is puzzling both politicians and economists. While the Fed seems confident, estimating inflation will drop to 2.2% for August from a 7% peak two years ago, inflation is still a concern for many Americans.

Adjusting to New Prices

Sofia Baig, an economist at Morning Consult, explains that people tend to compare current prices to those from years ago. This makes it harder to adjust to the idea that inflation has always been there, and now it’s just about getting used to new price levels. Social media also fuels this perception, and the impact of the pandemic lingers on many people’s financial outlooks.

Prices, Inflation, and Politics

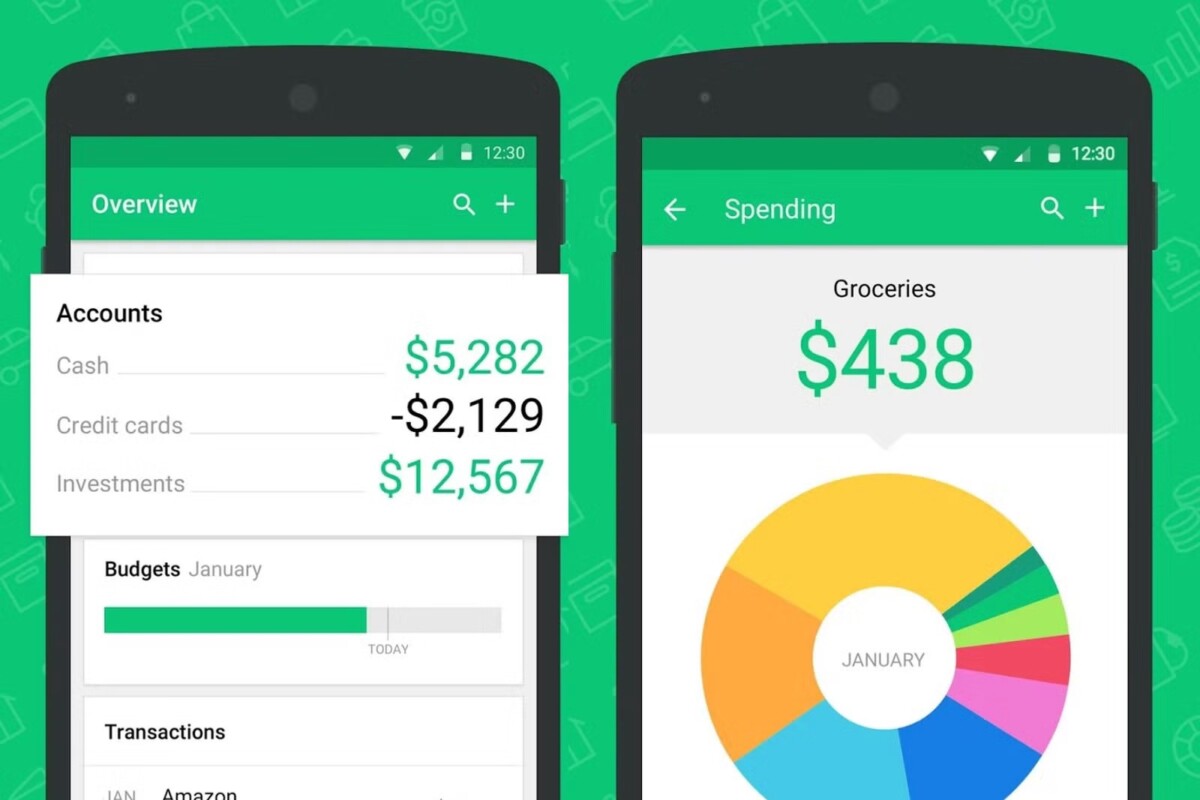

Despite negative sentiment, there’s some positive news. Grocery prices are up only 0.9% in the past year, while gas prices have dropped 17%. New rental costs have decreased, and median household income outpaced inflation by 4% in 2023.

Federal Reserve board member Christopher Waller even suggested inflation could soon dip below the 2% target, noting that core inflation over the past four months is at 1.8%.

Meanwhile, the political climate is shifting. The poll found voters are now split on whether former President Trump or Vice President Harris would better manage the economy, a change from a June poll that showed most disapproved of President Biden’s economic performance.