Discover the key drivers behind the current cryptocurrency market boom and learn how to navigate this dynamic landscape while managing risks effectively.

The Current Crypto Landscape

The crypto market has bounced back strongly after a challenging period, showing signs of renewed strength across major cryptocurrencies. You can see this recovery reflected in rising trading volumes and increased participation from both retail and institutional investors.

The market’s growth is powered by big companies like BlackRock and Fidelity stepping into crypto with new investment products. Clear rules from regulators in many countries are making it easier for you to safely invest in digital assets, while improvements in blockchain technology have made transactions faster and cheaper than ever before.

This crypto boom feels different from previous ones because it’s built on real-world use cases and solid infrastructure rather than just speculation. The presence of established financial institutions and better consumer protections means you’re looking at a more mature market with stronger foundations.

Institutional Money Flow

The crypto market is seeing a massive wave of institutional money, with BlackRock and Fidelity now managing billions in crypto assets through their spot ETFs. Major banks and investment firms have poured over $50 billion into various crypto projects and platforms in the past year alone.

This surge in institutional involvement is pushing crypto trading volumes to record highs and bringing more stability to daily price movements. You’re now seeing professional trading desks and risk management teams treating crypto just like any other financial asset class. The presence of these big players is helping create more efficient markets with tighter spreads, making it easier for you to buy and sell at fair prices.

The growing institutional presence points to a future where crypto becomes a standard part of investment portfolios, just like stocks and bonds. This shift will likely lead to more stable, mature markets that can better handle large trading volumes without the extreme price swings you’ve seen in the past.

Regulatory Environment

More countries are creating rules for how you can buy and sell cryptocurrencies, with some already having clear guidelines in place. The US Securities and Exchange Commission has been particularly active, making decisions about which crypto assets count as securities and which don’t.

You might worry that stricter rules will hurt crypto markets, but this fear isn’t backed by real-world examples. When countries set clear rules, it becomes easier for banks and big companies to offer crypto services to their customers. These regulations also help protect you from scams and make it safer to invest your money.

New crypto regulations are expected to focus on stablecoin oversight and trading platform requirements. These changes will likely bring more institutional investors into the market, which could increase the value and stability of your crypto investments.

Market Infrastructure

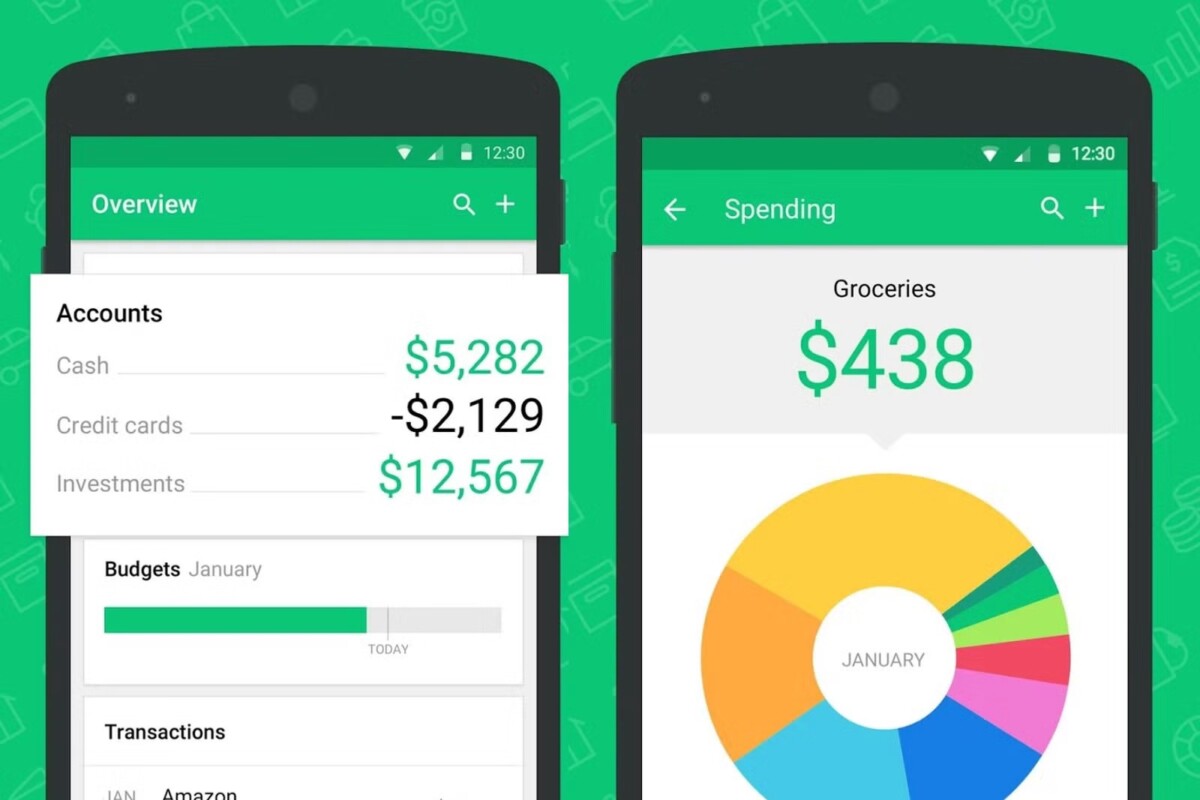

The crypto market has grown more reliable with trading platforms that now match the quality of traditional financial markets. You can now trade cryptocurrencies through platforms that offer the same speed and reliability you expect from your regular stock trading account.

Better market infrastructure has made it much harder for bad actors to manipulate crypto prices through wash trading or other schemes. The new systems can detect and prevent suspicious trading patterns in real-time. Security has also improved with cold storage solutions, insurance coverage, and regular third-party audits becoming standard practice.

New developments in settlement systems and cross-platform trading networks will soon make crypto trading even more secure and efficient. These improvements will help you trade with greater confidence while keeping your assets safe.

Retail Investment Trends

Recent data shows that more young adults between 25-35 are joining the investment world than ever before. Social media and mobile trading apps have made investing more accessible to people from diverse economic backgrounds.

Many people think crypto investing is just about making quick profits through risky trades. The reality is that many retail investors use cryptocurrencies as part of a balanced investment strategy, similar to how they approach stocks or bonds. More importantly, a growing number of retail crypto investors are focusing on long-term value and the underlying technology potential.

You can improve your investment results by starting with a clear plan that matches your financial goals and risk tolerance. Consider spreading your investments across different assets and only invest money you can afford to keep invested for at least several years.

Technological Advances

The cryptocurrency ecosystem has seen major improvements with the rise of Layer 2 solutions that process transactions faster and cheaper than before. New consensus mechanisms have also made crypto networks more energy-efficient, using just a fraction of the electricity they once needed.

These advances have helped crypto networks handle millions more transactions per second, making them much more practical for everyday use. The improved speed means you can now send crypto as quickly as using a credit card, while paying much lower fees. Better energy efficiency has also made these networks more environmentally friendly, addressing a common criticism of early crypto systems.

Exciting developments in quantum-resistant encryption and cross-chain bridges are coming soon to make your crypto assets even more secure and useful. These improvements will let you move your crypto between different networks more easily and protect your investments against future security threats.

Market Correlation Shifts

The relationship between cryptocurrency and traditional markets isn’t as simple as it used to be. Your assumptions about Bitcoin following the stock market might need an update, as correlations have become more complex and dynamic over time.

Many investors still think of crypto as just another risky bet, like tech stocks or junk bonds. But the data shows that crypto often moves independently during major market events, such as the banking crisis of 2023. You’ll find that Bitcoin has even shown gold-like properties during certain periods of economic stress.

This changing relationship means you can use crypto differently in your investment mix. Your portfolio could benefit from crypto’s unique behavior, especially during times when traditional assets struggle to deliver returns.

Global Economic Impact

Cryptocurrency has become a significant part of daily financial transactions, with millions of people using it to send money across borders without traditional banking fees. You can now use crypto to pay for everything from your morning coffee to major purchases at thousands of businesses worldwide.

Many critics have questioned whether cryptocurrencies serve any real purpose beyond speculation and trading. Yet, crypto has proven its worth in countries with unstable currencies, where people use it to protect their savings from inflation. Small businesses, especially in developing regions, have started accepting crypto payments to reach international customers without dealing with complex banking systems.

The growing acceptance of cryptocurrencies by major financial institutions signals a shift in how money moves around the world. You might soon see crypto becoming as common as credit cards for everyday purchases, fundamentally changing how we think about and use money.

Environmental Concerns

Cryptocurrency mining currently uses as much energy annually as some small countries. The high energy consumption has sparked heated debates about crypto’s role in climate change and its environmental sustainability.

You might have heard that crypto mining always harms the environment, but this isn’t entirely accurate. Many mining operations are actually moving towards renewable energy sources like solar and hydroelectric power. More miners are setting up their operations in regions with excess renewable energy capacity, turning what would be wasted energy into productive use.

The crypto industry is actively working to reduce its carbon footprint through innovative solutions and green initiatives. Several major crypto projects are developing new, energy-efficient consensus mechanisms that will dramatically reduce power consumption while maintaining network security.

Risk Management

In the current crypto boom, managing your investment risks isn’t just smart – it’s essential for survival. The fast-paced nature of crypto markets means you can make or lose money quickly, making proper risk management your best friend.

You can protect your crypto investments by following three key strategies. First, never put more than 5-10% of your total investment money into crypto. Second, spread your crypto investments across different coins instead of betting everything on one. Third, use stop-loss orders to automatically sell if prices drop below your comfort level.

Remember that successful crypto investing is more like a marathon than a sprint. You’ll do better if you stay calm and stick to your risk management plan instead of making emotional decisions based on market ups and downs.

Future Market Outlook

The market shows promising signs of expansion in the next five years, with steady growth expected across multiple sectors. You can expect to see particularly strong performance in renewable energy, healthcare technology, and sustainable consumer goods.

Market experts have raised valid concerns about potential overvaluation in certain tech sectors, particularly in AI-related stocks. Some warning signs include high price-to-earnings ratios and increased speculative investing by retail traders. However, traditional market indicators still suggest overall stability in most established industries.

You should consider building a balanced portfolio that can weather different market conditions by mixing growth and value investments. Smart investors are also keeping some cash reserves ready to take advantage of any market corrections that might come up.

Common Questions

Is this crypto boom different from 2017?

Yes, the current crypto market is fundamentally different from 2017. The biggest change is the involvement of major financial institutions and companies, rather than just individual investors.

You’ll notice more regulation, better security measures, and more real-world use cases for cryptocurrencies. Banks, payment processors, and investment firms now offer crypto services.

How much should I invest in crypto?

Never invest more than you can afford to lose in crypto. A common recommendation is to limit crypto investments to 5-10% of your investment portfolio.

Your crypto investment should fit into your broader financial plan. Start small and increase your position gradually as you learn more about the market.

What are the biggest risks right now?

Regulatory changes remain the biggest risk in crypto markets. Different countries keep changing their stance on crypto regulations, which can affect prices quickly.

Other major risks include:

- Market volatility and price swings

- Security threats and hacking attempts

- Technical issues with blockchain networks

- Market manipulation by large holders

Is it too late to invest?

No, it’s not too late to invest in crypto. The market is still developing, and many experts believe we’re still in the early stages of crypto adoption.

Think of crypto investment as a long-term strategy. Focus on understanding the technology and its potential uses rather than trying to time the market for quick profits.

How do I protect my crypto investments?

Security should be your top priority when investing in crypto. Always use two-factor authentication on your accounts and consider using a hardware wallet for large amounts.

Keep your private keys safe and never share them with anyone. Write down your recovery phrases on paper and store them in a secure location.

What role will CBDCs play in the crypto market?

Central Bank Digital Currencies (CBDCs) will likely become a major part of the digital currency ecosystem. They’ll provide a bridge between traditional finance and crypto markets.

CBDCs might make digital payments more common and help people understand blockchain technology better. However, they’re different from decentralized cryptocurrencies and will serve different purposes.