Welcome to a pivotal stage in your financial journey—your 20s! This decade is brimming with exciting opportunities, personal growth, and, yes, financial responsibility. While it’s a time for adventure and exploration, it’s also the ideal moment to set the foundation for a strong and secure financial future.

One crucial tool that can help you achieve your financial goals is the right credit card. In your 20s, the decisions you make about credit can have a lasting impact on your financial well-being. The right credit card can offer rewards, benefits, and valuable building blocks for your credit history.

But with the myriad of credit card options available, how do you choose the best one for your unique needs and aspirations? That’s where we come in. In this comprehensive guide, we’ll walk you through the top credit card choices tailored specifically for those navigating the exciting landscape of their 20s.

Whether you’re a college student just starting out, a young professional building your career, or someone with a specific financial goal in mind, we’ve got you covered. We’ll explore a range of credit cards that cater to various financial profiles, lifestyles, and goals. Plus, we’ll provide expert insights and tips on how to make the most of your credit card while avoiding common pitfalls.

So, if you’re ready to embark on this financial adventure and make informed choices about your credit, keep reading. Let’s explore the best credit card options that can help you thrive in your 20s and set you on the path to financial success.

Discover IT Card:

If you’re in college and just starting your credit journey, the Discover IT card is the best route.

Discover IT is one of the best cards for those starting out, wanting to build credit, since it has no annual fee and has amazing cash back match rewards.

Discover’s IT card guarantees that at the end of the first year of using the card, the amount of cash back you accumulate will be 100% matched. So, if you were to spend enough to get $100 in cash back from using the card, Discover will match that amount and give you another $100 on top of it. This offer is only available for the first year you activate your card, but don’t let that deter you, the card has other great rewards.

These rewards all come in the form of mainly cash back at gas stations, grocery stores, along with target and Amazon, but there are numerous versions of the Discover IT card, to personally suit your needs.

Types of Discover IT Cards:

- Discover IT Cash Back®

- Discover IT Miles®

- Discover IT Chrome®

- Discover IT Secured®

Chase Sapphire Preferred:

If you plan on traveling, but don’t need the fancy lounges or high Annual fee, the Sapphire Preferred is for you.

The Chase Sapphire Preferred ® Card is easily one of the best beginner travel cards you can get in 2024. It starts you off with a very impressive welcome bonus of 60,000 points, as long as you spend $4,000 in the first 4 months of activating your card.

Individuals who hold this card can accumulate points at a rate of 5 times the normal amount when making travel-related purchases through Chase Ultimate Rewards®. Dining, including qualifying delivery services and takeout orders, also earns cardholders 3 times the regular points. Moreover, they can enjoy 3 times the points for specific streaming services and online grocery shopping (with exceptions for Target, Walmart, and wholesale clubs). Other eligible travel expenses bring in 2 times the points, while all other purchases accumulate points at a rate of 1 point per dollar spent.

Amex Gold:

If you are a human being and spend money weekly at the grocery store, or at restaurants and occasionally on flights, the Amex Gold is for you.

It comes with 4X points at restaurants worldwide, plus takeout and delivery in the U.S. On top of that, it includes 4X points on Groceries at U.S. Supermarkets on up to the first $25,000 purchases per year. As someone in your 20’s this may be a tough number to surpass, so you will be receiving this large point benefit every year, on every single purchase! Lastly, If you have to travel anywhere, you get 3X points on all flights when booked directly through amextravels.com! It may not come with all the fancy lounge accesses like it’s brother card, the Amex Platinum card, but points back on flights is amazing, especially when you’re frequently traveling home from college for all of the holidays.

Just keep in mind that the Amex Gold Card is a charge card, and everything spent on it during that month has to be paid off in full at the end of the statement month.

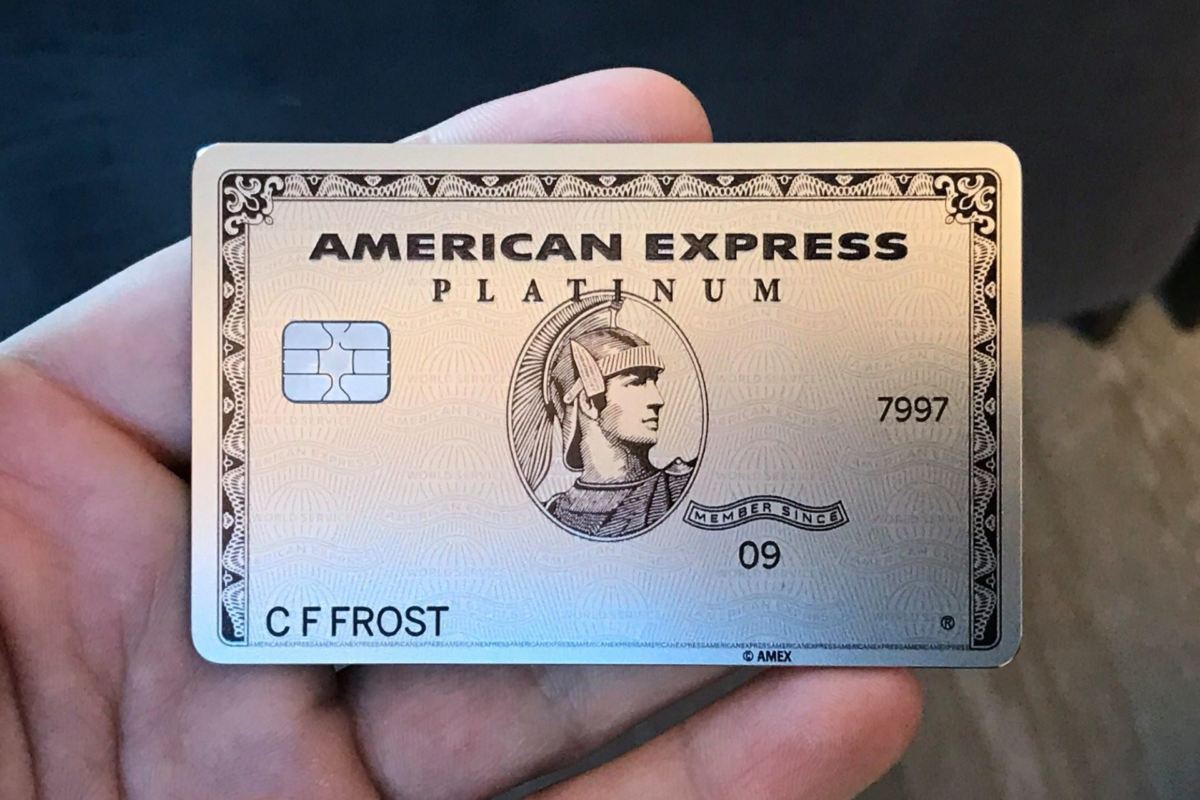

Amex Platinum:

If you’re a frequent traveler inside and outside of college, and are okay with a higher annual fee for a card with endless benefits, the Amex Platinum may be more in your wheelhouse!

The Amex Platinum card is one of the best cards out there, coming in with access to over 1,500 + lounges in all airports, TSA pre-check and a whole lot more.

Just like the Amex Gold Card, the Amex Platinum Card is another charge card, which means that everything you spend on it in that statement month has to be paid off in full, unlike credit cards! So spend responsibly!

Our Recommendations:

While all of these cards are amazing for your twenties and onward, there are two standouts that are unbeatable when paired together. These two cards are The Amex Gold and Amex Platinum, as they hold the greatest rewards for everyday use and traveling occasions.

It would be criminal not to give this duo there own post, to dive into details further, so check out the post on these cards here!